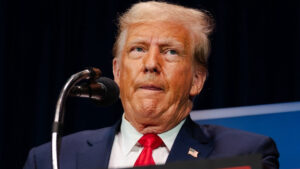

Stock of Trump’s Social Media Platform Nears Rock Bottom as Financial Troubles Mount

Shares of Truth Social, the social media platform spearheaded by Donald Trump, are rapidly approaching their lowest levels since its public debut as reported by Newsweek on Friday, June 21, 2024.

The platform, launched in February 2022, came as a response to Trump’s bans from Twitter (now X) and Facebook following his posts related to the January 6 Capitol riots. Although he has been reinstated on these platforms, Trump remains active primarily on Truth Social.

This year, shareholders of Digital World Acquisition Corp., a special purpose acquisition company (SPAC), approved a merger with Truth Social’s parent company, Trump Media & Technology Group (TMTG). This move was intended to facilitate the public listing of Trump’s media venture.

However, since the merger, the stock’s value has experienced significant volatility, with a notable downward trend in recent weeks. Data from Google Finance as of June 21 shows that shares of TMTG traded under the ticker “DJT,” have dropped to $26.75, marking a 14.56 percent decrease from its value the previous Thursday.

This price is perilously close to the stock’s historic low of $22.84, observed on April 16, and even lower than its January 16 valuation of $22.35. The decline has been consistent since June 12. Trump holds a substantial stake in TMTG, owning approximately 65 percent of the company.

Earlier this month, TMTG granted him an additional 36 million shares, increasing his total holdings to 114.75 million shares, according to filings with the Securities and Exchange Commission (SEC). Financial challenges for TMTG extend beyond the stock market. The company reported a staggering net loss of $327.6 million for the first quarter of 2024.

This loss primarily stemmed from non-cash expenses related to its merger with Digital World Acquisition Corp. In contrast, TMTG had posted a net loss of $210,300 in the first quarter of the previous year.

Trump’s legal troubles have also cast a shadow over the platform’s financial health. Last month, following his conviction for falsifying business records in a hush-money case, Truth Social’s stock suffered a significant blow. Experts suggest that Trump’s legal issues may have influenced the stock’s poor performance.

As a result of the stock’s declining value, Trump reportedly lost an estimated $267,367,500 over the past weekend. This considerable financial hit has added to the company’s woes. Commenting on the stock’s performance, Todd Landman, a political science professor at the University of Nottingham in the UK, told Newsweek that the stock would likely experience “continued volatility” in the coming weeks.

“The stock value continues to perform badly and is nearing its 52-week low,” he said. “This low performance is owing in part to the legal developments in Manhattan and the rejection of a motion to remove the gag order, which means that content that normally would attract users is not being posted.”

Landman expressed surprise at the platform’s content strategy, or lack thereof. “I am surprised that the platform is not posting more forward-looking content, which could attract users back. I think we can expect continued volatility with the Presidential debate next week, followed by the Manhattan sentencing, and the RNC convention.”

Despite his conviction, Trump maintains his innocence in the case of falsifying business records and is contemplating an appeal. His legal battles and their implications for his businesses, including Truth Social, remain a focal point of public and investor scrutiny.