“Shocking Reasons Why Republicans Can’t Push Through Trump’s Tax Plan!”

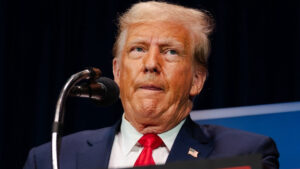

[Evan Vucci/AP Photo

Republicans don’t have the appetite for their presidential candidate’s desired deficit spending, analyst says

Donald Trump and Kamala Harris have competed in recent weeks to win voters with a slew of economic policies that would put more money in the pockets of American taxpayers – but which would also have potentially damaging effects on the U.S. economy and federal budget deficit.

Former President Trump added to the list of proposals Thursday, proposing to lower the corporate tax rate from 21% to 15% for “companies that make their products in America,” while promising to fund child-care subsidies with revenue from new taxes on imported goods.

But investors would be better served paying attention to what congressional leaders are saying and have done in the past for clues on tax policy going forward, according to Henrietta Treyz, director of economic policy at Veda Partners.

“The most important variable that will determine the fate of tax rates in 2026 and beyond is not the presidential election, but the U.S. Senate elections,” she wrote in a Thursday note to clients. “The House of Representatives and U.S. Senate write tax bills, the president just signs what they’re given.”

No matter who wins in November, Congress and the president will be faced with the expiration after 2025 of individual tax cuts and other benefits that were included in the tax reform bill that President Trump signed into law in 2017.

These tax cuts were written to expire so that Republicans could pass the law on a party-line vote. Bills that increase the budget deficit outside of a 10-year window require 60 votes to pass the Senate, and therefore bipartisan support.

Treyz argued that neither Trump nor Harris would dare veto a bill sent to them by Congress, as a failure to finalize legislation would result in tax increases for most American families.

Tallying the price tag for the many policies Trump has promoted during his campaign illustrates just how difficult it will be for the former president to enact them.

Trump has promised to make permanent all the individual income tax cuts from the 2017 law, which would cost $3.4 trillion over 10 years, according to the Penn Wharton Budget Model. Other proposals include:

Eliminating taxes on Social Security benefits would cost $1.2 trillion. Extending business tax provisions, costing $623 billion.Eliminating taxes on tips, at a cost of upwards of $250 billion.Lowering the corporate tax rate to 15% – costing upwards of $595 billion, depending on the implementation of domestic production rules.

Penn Wharton estimates that the tax cuts would stimulate economic activity, bringing down the cost of these provisions somewhat.

Still, the price tag of these proposals could run north of $4.4 trillion, a cost that Treyz says Senate Republicans will balk at.

She predicts that if Trump wins the election, he will likely have slim majorities in both the Senate and House to work with, but that these members will be thinking primarily of their own political futures rather than the president’s policy vision.

“The biggest problem here is the deficit increases the party will have to vote for when they write this bill,” Treyz wrote. “Historically, when Republicans vote to increase the deficit by too much … they lose their re-election bids.”

Further complicating the picture for Republicans is that the 2017 tax bill was paid for in large part by capping the amount of state and local taxes that households can deduct from their federal tax bill.

That provision is a big money saver and only affects a wealthy slice of the taxpaying public – but if Republicans keep the House of Representatives, they would do so with the votes of 18 GOP representatives from high-tax districts “who will have a hard time voting to maintain the $10,000 cap when the alternative is a reversion to the unlimited 2017 levels,” Treyz wrote, arguing that an extension of the law will require increasing that cap to about $40,000 at high cost.

She said that Republican leaders in the Senate have only the appetite to approve $2.5 trillion in new deficit spending, leaving only enough room to extend the 2017 tax cuts for five more years.

“Simply put,” Treyz wrote, “Republicans don’t have the votes to do what Trump is promising on the campaign trail, let alone eliminating taxation of tips … or exempting Social Security benefits from taxation.”

-Chris Matthews

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.