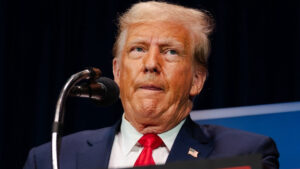

“If Trump Wins, Say GOODBYE to Your Social Security” Dem Congressman’s Dire Warning to Americans

Democratic Congressman Eric Swalwell of California has sounded the alarm about the future of Social Security should Donald Trump win reelection in November. His warning comes amid ongoing debates and concerns over the stability and funding of Social Security, a cornerstone of retirement security for millions of Americans.

Swalwell’s remarks were prompted by a post from the Heritage Foundation, a conservative think tank, on a social media platform, where they presumably discussed their views on Social Security reform or policy under different presidential administrations. Reacting strongly to this, Swalwell took to Twitter or another platform to express his apprehensions, which reverberated across social media and drew attention from both sides of the political spectrum.

“Say GOODBYE to your social security and plan to work into your 70s. This is their plan,” Swalwell tweeted, encapsulating his concern about what he perceives as potential consequences of Trump’s reelection for Social Security recipients. According to a report by Newsweek on Thursday, June 20, 2024, Social Security has long been a contentious issue in American politics, with both parties presenting different visions for its future.

Established in the 1930s under President Franklin D. Roosevelt’s New Deal, Social Security provides financial benefits to retired workers and their families, as well as to disabled individuals and survivors of deceased workers. The program is funded primarily through payroll taxes levied on wages, with benefits calculated based on an individual’s earnings history.

Swalwell’s assertion that a Trump presidency would jeopardize Social Security hinges on contrasting policy positions between Democrats and Republicans regarding the program’s funding, structure, and long-term sustainability. Democrats generally advocate for maintaining or expanding Social Security benefits, while proposing increases in payroll taxes or other revenue sources to ensure its solvency.

In contrast, Republicans have proposed various reforms over the years, including potential adjustments to eligibility ages, benefit calculations, or even partial privatization, arguing for fiscal responsibility and long-term viability. Critics of Swalwell’s statement argue that it represents fearmongering or hyperbole designed to sway public opinion against Trump’s reelection bid.

They point to ongoing bipartisan efforts in Congress to address Social Security’s financial challenges through legislative measures aimed at ensuring its stability for future generations. Proposals often include a combination of benefit adjustments, revenue enhancements, and administrative reforms to strengthen the program without drastic changes that could impact current beneficiaries.

However, Swalwell’s warning taps into broader concerns among some voters and advocacy groups who view Social Security as vulnerable to political shifts and budgetary pressures. The program faces demographic challenges as the baby boomer generation retires in large numbers, placing strains on its funding mechanisms.

Additionally, economic fluctuations, such as recessions or prolonged periods of slow growth, can impact the program’s finances and necessitate adjustments to ensure its long-term sustainability. In response to Swalwell’s remarks, supporters of Trump and conservative commentators have highlighted the administration’s efforts to bolster the economy, reduce unemployment, and stimulate wage growth as factors that could positively influence Social Security’s financial outlook.

They argue that a strong economy and prudent fiscal management can contribute to the program’s stability by increasing payroll tax revenues and reducing reliance on deficit spending. As the 2024 presidential election approaches, discussions surrounding Social Security are likely to intensify, with candidates from both parties expected to outline their positions and proposals for the program.

Voters, particularly older Americans and those nearing retirement age are likely to scrutinize these policies closely, weighing potential impacts on their retirement planning and financial security. Swalwell’s warning serves as a stark reminder of the stakes involved in the election, highlighting the competing visions and policy priorities that will shape the future of Social Security and retirement benefits in the United States.

Whether his prediction of Social Security’s peril under a Trump presidency resonates with voters remains to be seen, but it underscores the importance of informed debate and civic engagement on issues critical to the nation’s social safety net. As the campaign season progresses, expect Social Security and related retirement issues to remain at the forefront of political discourse, with candidates and lawmakers seeking to sway public opinion and secure voter support based on their proposed solutions to ensure the program’s long-term viability and sustainability.